The family feud that’s tearing apart one of Canada’s richest families is getting nastier.

Former Magna International Inc. Chief Executive Officer Belinda Stronach — already the target of a $520 million lawsuit filed by her billionaire father Frank Stronach — is now being sued by her brother, Andrew. He says he’s lost trust in Belinda and wants her removed from a family trust and replaced by his father.

The suit claims Belinda and trustees “have undertaken a number of improvident and costly investments that have resulted in significant losses.” As a result, “the Stronach Group now finds itself in a liquidity crisis and is actively attempting to sell off valuable real estate and other assets.”

Andrew Stronach’s lawsuit, filed Nov. 1 in Toronto, is the latest twist in an increasingly bitter dispute that erupted after Frank Stronach left Canada in 2013 for a brief foray into politics in his native Austria — handing control over a key trust to his daughter, now 52, and trustees such as Alon Ossip, a former Magna executive.

Since November 2013, the lawsuit says, Belinda Stronach has controlled various trusts and companies that form the Stronach Group and hold most of the wealth created by the Magna founder. Andrew, whom the lawsuit says “has dedicated his life to agricultural pursuits,” owns 23 per cent of the Stronach Group through his own trust.

This year, as the dispute intensified, Andrew made numerous attempts to obtain “a proper accounting” for the trust — such as the three most recent financial statements. “To date, Andrew’s proper and reasonable requests for information have been ignored, or only partially answered after lengthy delays and following repeated requests for disclosure,” according to the lawsuit filed with the Ontario Superior Court.

‘Complete breakdown’

As a result of Belinda’s conduct, “there has been a complete breakdown in trust and confidence” between Andrew, his parents and the so-called “Belinda trustees,” according to the lawsuit. “Andrew has no confidence in the willingness or ability of the Belinda trustees to discharge properly, or at all, their duties as trustees.”

No statement of defence against either lawsuit has yet been filed.

“The filing on behalf of my brother is an extension of my father’s legal pursuit against me and my children, and the allegations remain just as untrue,” Belinda Stronach said in a statement Monday. “We will be responding formally in due course. It saddens me greatly that we have reached this juncture in our family.”

Paul Deegan, a spokesman for Ossip, called the claims “wholly without merit. Mr. Stronach and his lawyers have been provided with detailed financials of the trusts and subsidiary corporations. They have also been offered access repeatedly to key individuals in the organization to answer any questions and provide additional information. This is a Stronach family dispute that should be resolved by the family.”

In the original suit, Frank Stronach, 86, claims Belinda is starving his grass-fed-cattle farm of financing, selling off assets over his objections while using company funds to bankroll an extravagant lifestyle of parties, vacations and limousine rides.

Magna origins

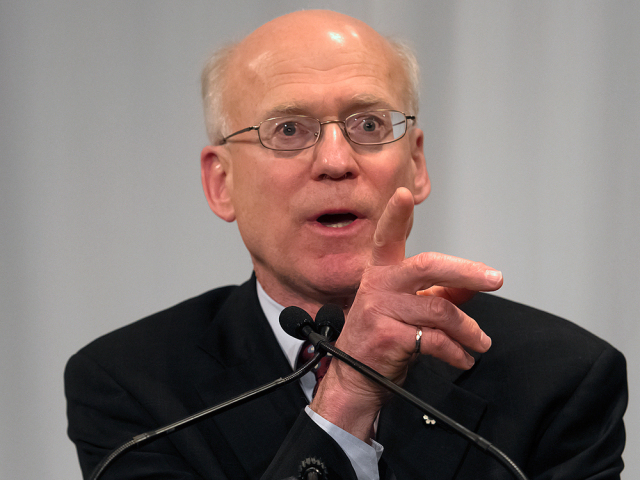

Frank Stronach, who built Magna into a global auto-parts giant from a one-man shop, and his wife, Elfriede, say their relationship with their daughter has suffered a “complete breakdown.” The lawsuit against her is a “last resort” after trying for 20 months to find a settlement, according to a 73-page statement of claim filed in a Toronto court on Oct. 1.

The couple is seeking $520 million in compensation from Belinda, Ossip and her two adult children, Nicole and Frank Walker, whose father Don Walker is the current CEO of Magna. They want Belinda and Ossip removed from the management of various family companies and trusts.

Key to the lawsuit are what Frank and his wife say were “covert” and “unlawful” actions to appropriate family assets from at least 2011 until November 2016 — when the suit says Belinda and Ossip took the view that Frank was no longer in control of the family empire.

“Belinda and Alon have asserted control over the Stronach Group in an oppressive manner and have taken steps to shut the rest of the Stronach family out of the family’s business,” Frank says in the suit.

‘Belinda and Alon have asserted control over the Stronach Group in an oppressive manner and have taken steps to shut the rest of the Stronach family out,’ Frank said in his suit

Hormone-free

Frank Stronach’s post-Magna life has included a stint as a member of parliament in his native Austria from late 2013 to early 2014, the development of Adena Farms, a Florida-based agricultural business dedicated to producing hormone-free, grass-fed beef, and a golf and country club in Florida that included restaurants serving all-natural foods. Stronach is worth about $1.9 billion, according to the Bloomberg Billionaires Index.

After demanding that Frank “take immediate steps to rein in or terminate” expenditures associated with Adena and other ventures, Belinda and Ossip moved to “impair, undermine and dismantle” the agricultural businesses — cutting off funding, cancelling leases and laying off employees, according to the Oct. 1 suit. As a result, Adena Farms has been “placed in a precarious position and may never reach its full potential.”

Extravagant lifestyle

Separately, the suit alleges Belinda, who ran Magna from 2001 to 2004, has appropriated more than $70 million to maintain her lifestyle over the years, “routinely” asking to be reimbursed for “hundreds of thousands of dollars” of personal expenses — including parties, vacations, limousine rides and expensive meals.

That included the $10 million purchase and refurbishment of a personal office in Toronto — at a time when the Stronach group was suffering from liquidity issues, an “irresponsible” and “extravagant” move when Magna and related companies already have offices nearby in Aurora, Ont., about 50km north.