Nach einem Eklat während einer Pressekonferenz von US-Präsident Donald Trump hat das Weiße Haus dem beteiligten CNN-Journalisten Jim Acosta die Akkreditierung „bis auf Weiteres“ entzogen. Das teilte Regierungssprecherin Sarah Sanders am Mittwochabend mit.

Acosta selbst erfuhr von der Entscheidung offenbar erst, als er am Eingang zum Weißen Haus gestoppt wurde: „Mir wurde gerade der Eintritt ins Weiße Haus verweigert“, schrieb der Journalist auf Twitter. Der Secret Service habe ihn informiert, er könne nicht eintreten, so Acosta weiter.

In einem Video, das der Journalist kurz darauf ebenfalls auf Twitter veröffentlichte, ist zu sehen, wie ihm ein Sicherheitsmann den Ausweis abnimmt. Die Unterhaltung der beiden ist friedlich, Acosta betont „no hard feelings“, um klarzustellen, dass er dem Mann nichts vorwirft. Dann ist zu hören, wie der Weiße-Haus-Mitarbeiter sagt: „Sie sind hier schon eine Weile.“ Fünf Jahre, antwortete Acosta.

Trump hatte am Mittwoch auf offener Bühne einen handfesten Streit mit Acosta angezettelt. „Sie sind eine furchtbare, unverschämte Person“, fuhr der Präsident den in den USA bekannten Reporter an. Acosta hatte einer Mitarbeiterin des Weißen Hauses das Mikrofon aus der Hand gerissen und sich geweigert, dieses zurückzugeben. Das wurde nun als Anlass für den Entzug seiner Akkreditierung genommen.

Auch wenn Trump an eine freie Presse glaube und schwierige Fragen über sich und seine Regierung begrüße, heißt es in der Mitteilung von Sanders, werde derartiges Verhalten gegenüber einer jungen Mitarbeiterin des Weißen Hauses „niemals toleriert“. Dass sich CNN nunmehr stolz über die Arbeit ihres Reporters geäußert habe, sei „nicht nur widerlich, sondern auch ein Beispiel ihrer empörenden Missachtung für alle, auch junge Frauen, die in dieser Regierung arbeiten“.

Der Reporter hatte Fragen zu den laufenden Russland-Untersuchungen von Sonderermittler Robert Mueller gestellt. „Wenn Sie Fake News in die Welt setzen, was CNN tut, dann sind Sie der Feind des Volkes“, warf ihm Trump unter anderem vor. CNN solle sich schämen, einen Menschen wie Acosta zu beschäftigen.

Der US-Präsident sprach während der Pressekonferenz außerdem von „feindseligen Medien“. Mehrmals forderte er Journalisten auf, den Mund zu halten. Trump war bereits vor fast zwei Jahren in New York – noch vor seiner Amtseinführung – in Aufsehen erregender Weise mit Acosta aneinandergeraten, weil ihm dessen Fragen nicht gefallen hatten.

Der Sender CNN verurteilte in einem Statement die Äußerungen Trumps. „Die andauernden Angriffe des Präsidenten auf die Presse sind deutlich zu weit gegangen“, heißt es darin. „Sie sind nicht nur gefährlich, sie sind verstörend unamerikanisch.“ Trump habe zwar einen Eid auf die in der US-Verfassung festgeschriebene Pressefreiheit geleistet und sei somit zu deren Schutz verpflichtet, er habe aber wiederholt deutlich gemacht, dass er für die Pressefreiheit keinerlei Respekt übrig habe. „Wir stehen hinter Jim Acosta und seinen Kollegen überall“, heißt es in der Antwort der Firmenleitung auf den Streit Trumps mit dem Reporter.

Der Verband der im Weißen Haus akkreditierten Korrespondenten (WHCA) hat den Entzug der Akkreditierung für Acosta als „schwach und fehlgeleitet“ kritisiert. Den Zugang zum Weißen Haus zu widerrufen stehe in keinem Verhältnis zu dem angeblichen Vergehen und sei „nicht akzeptabel“, heißt es in einer Erklärung. Der WHCA forderte das Weiße Haus auf, die Entscheidung rückgängig zu machen.

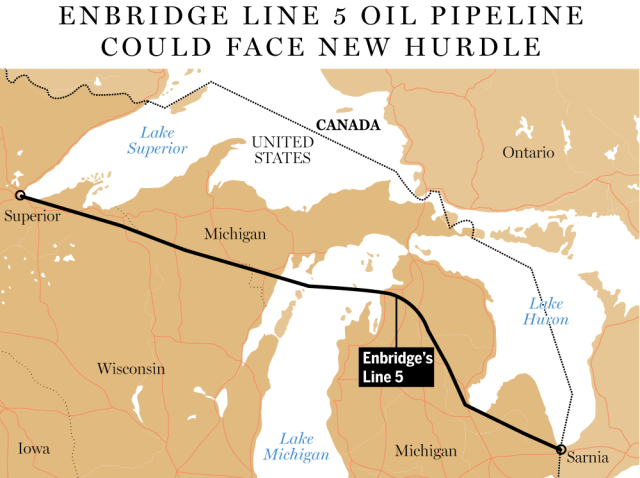

He also acknowledged that Canadian oil pipelines are constrained, leading to record-setting discounts for domestic crude and that new production will require new pipeline capacity or move on railway cars.

He also acknowledged that Canadian oil pipelines are constrained, leading to record-setting discounts for domestic crude and that new production will require new pipeline capacity or move on railway cars.